virginia estimated tax payments due dates 2020

If full payment of the. 2020 Maryland individual returns and the first two 2021 quarterly estimated payments.

Prepare And E File Your 2021 2022 West Virginia Tax Return

Extend the due date for certain Virginia income tax payments to June 1 2020 in response to the coronavirus disease 2019 COVID-19 crisis.

. Individual and corporate extension payments for TY 2019. April 10 2022 Beer and Wine Tax. Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals.

Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher f. Any tentative tax due must be paid using extension voucher Form 760IP by this years adjusted payment due date of June 1 2020 when filing the return. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

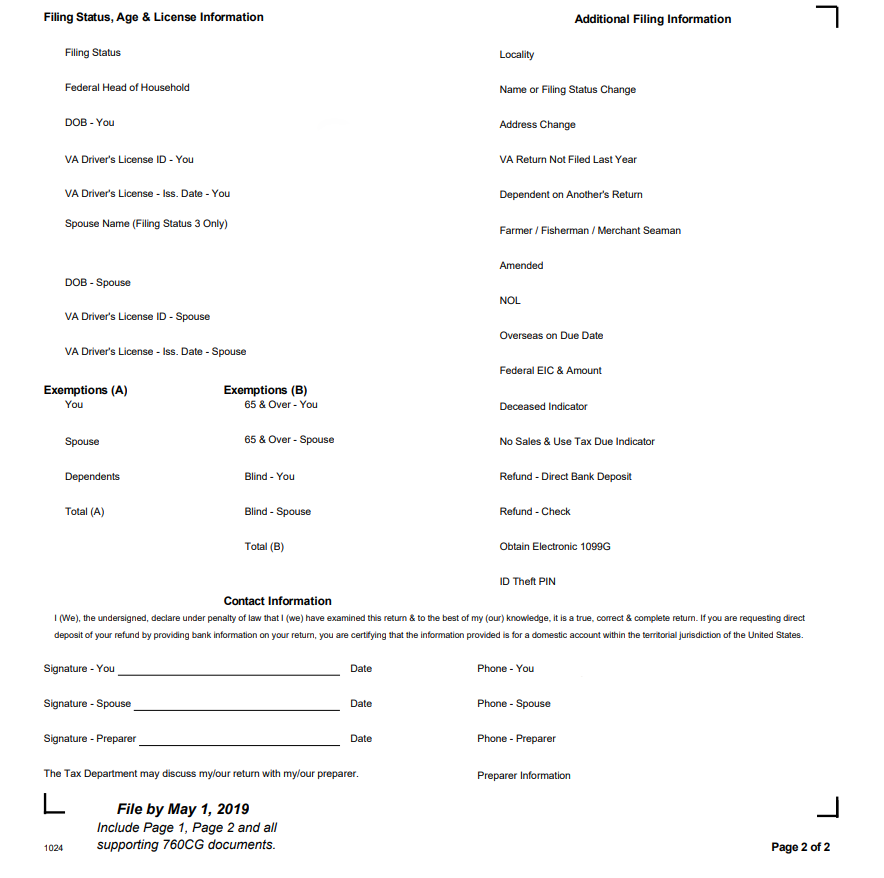

Virginia 2020 individual returns are now due May 17. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan. No penalties interest or addition to tax will be charged if payments.

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. West Virginia Code 16A-9-1d Sales and Use Tax. If the due date falls on Saturday Sunday or a legal holiday the return or voucher may be filed on the first business day thereafter.

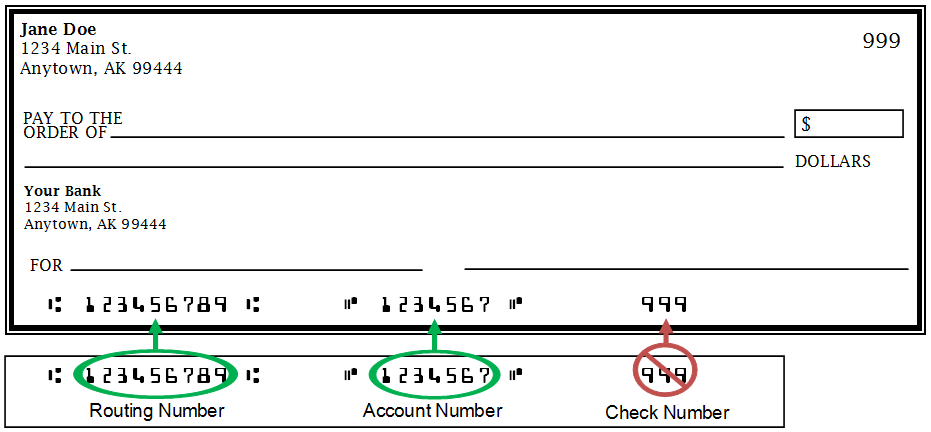

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Virginia Governor Ralph Northam announced that while filing deadlines remain the same the due date for payment of individual and corporate income tax will now be June 1. If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make.

Click IAT Notice to review the details. - Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soon. Virginia VA Estimated Income Tax Payment Vouchers and Instructions for Individuals Form 760ES PDF.

Estimated income tax payments must be made in full on or before May 1 2021 or in. At present Virginia TAX does not support International ACH Transactions IAT. The Virginia Department of Revenue will automatically extend the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or.

Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for.

Or fiduciary estimated Virginia income tax payments that are. Please enter your payment details below. Individual income taxes Corporate income taxes.

Please note a 35 fee may be assessed if your payment is declined by. Due to the COVID-19. Virginia 2020 individual returns are now due May 17.

Maryland taxpayers get a break. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Payment Voucher 1 by May 1 2020.

WWBT - The deadline for Virginias individual income tax payment deadline is June 1. Estimated income tax payments must be made in full on or before May 1 2020 or in equal installments on or before May 1 2020 June 15 2020. Enter your Virginia account number the ending month and year for the entire taxable year calendar fiscal or short taxable year for which the estimated payment is made not the.

First estimated income tax payments for TY 2020. 2020 Form 760ES Estimated Income Tax Payment Vouchers for Individuals. 28 2020 at 308 PM PDT.

Virginia Is Back As America S Top State For Business In 2021

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Tax Payment Options Chesterfield County Va

Virginia State Taxes 2022 Tax Season Forbes Advisor

Instructions On How To Prepare Your Virginia Tax Return Amendment

Virginia Dpb Frequently Asked Questions

Virginia Income Tax Calculator Smartasset

Pay Online Chesterfield County Va

1099 G 1099 Ints Now Available Virginia Tax

Uncle Scrooge Disney Life Times Version Character Profile Disney Cartoon Characters Walt Disney Characters Classic Cartoon Characters

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Where S My Refund West Virginia H R Block

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Virginia Dpb Frequently Asked Questions

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

Virginia Dpb Frequently Asked Questions

Publication 926 2020 Household Employer S Tax Guide Internal Revenue Service Tax Guide Online Taxes Fun Things To Do